Introduction:

The gold industry is one of the most mature and established investing markets. Previously it used to be a potential commodity. However, with possible uses in jewellery and electronics, it becomes a safe market to invest in for multiple reasons (Liu and Lee, 2022). The gold industry is signified as a haven asset since it switches in anti-correlation to the conventional markets and therefore it remains one of the greater hedges against financial challenges, but it also remains an asset that has experienced stable and steady growth in its value for a longer period old remains an asset that remains prone to an increasing volatility and price fluctuations, however, it is considered for its constant growth with the growth of its utilization and market demand. Forecasting the price of the fold for the future decade may lead to assertive gains in the long run (Fairbairn, 2021).

Background of gold price fluctuation:

Historically, the gold industry has been there for millions of years as one of the most valuable metals, however, it had not been used for money till about 550 B.C. In ancient periods people stored silver and gold coins. It was valued in the Roman Empire during the time of Emperor Augustus between 31 B.C. and 14 A.D. During this time the cost of 45 gold coins reached a pound. Also, the cost of an ounce of gold was 0.89 pounds in Great Britain as of 1257 (Esparcia et al.2022). After that, by the 1880s a majority of nations started printing paper currencies that were supported by their values in gold which had been called the gold standard. In 1971, Richard Nixon, the President of the United States instructed the Federation to stop honouring the value of dollars in gold followed by ending its primary utilization as a currency value which allowed for driving this asset to become a valuable asset to preserve. Gold price started taking off as an ounce became 40 dollars upon de-pegging from the dollar, however, within a decade it reached a value of $2,249 by 1980 (González et al.2021).

The current price of goal:

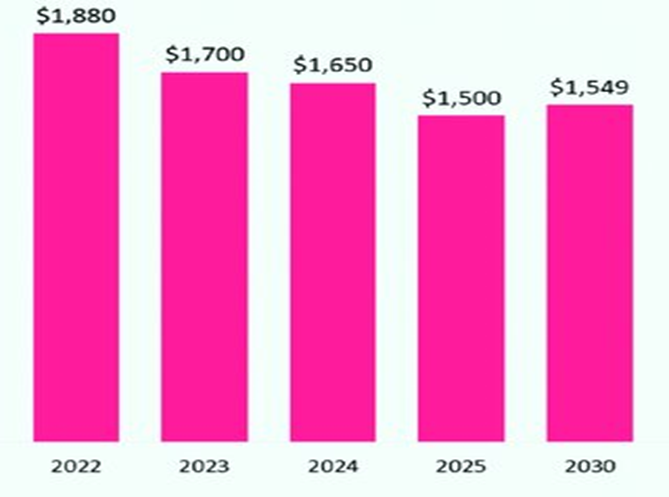

Figure 1. The gold price forecast

(Source: González et al.2021)

Presently, the price of gold has exponentially been increasing due to a concern relating to an impending recession as well as the requirement for a haven asset for investment (Smith, 2020). Before the development of these fears of recession, the gold industry remained leg behind making it feel unneeded and undervalued over the past decade, however, this is essential because it continued playing a potential role back in 2008 upon the hit of the last economic crisis. However, with the recovery of the global economy, the requirement for a safe haven asset was there with a gradual decline in gold price (Nguyen and Walther, 2020). Even though cryptocurrencies like Bitcoin have started gaining ground in gold in terms of market share, still gold should remain a reliable store of value in the upcoming era. Today the prediction of the price of gold and the forecast of the same by the end of this year seems to be rather assertive, considering the increasing geopolitical concerns at the start of 2024. The gold industry was slightly legged behind by the end of 2022, reaching a level of $1650 (Esparcia et al.2022). However, with the passing of time, people have started buying gold and have pushed the gold market up to over $2000 per ounce by the start of 2023. It has been anticipated that the gold industry will continue gaining attraction throughout 2024 and 2025 since there have been multiple banks like First Republic, Credit Suisse and Silicon Valley Bank that continue creation anxiety ripples through the markets (González et al.2021). Also, cryptocurrency involves a lot of fraudulent and suspicious activities people also become anxious after the bankruptcy of FTX and tend to invest more in gold resulting in a growing interest towards gold nowadays as compared to the past couple of years (Blas and Farchy, 2021).

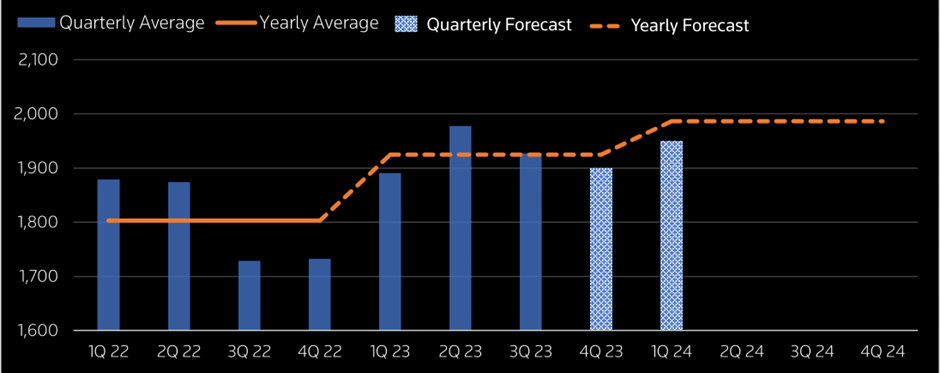

Figure 2. The present gold price and the predicted price by the end of this year

(Source: Liu and Lee, 2022)

With the continuation of the global economic downturn, a majority of large-scale investors have been showing interest in investing more in the gold market since it seems to sustain value even in the face of recessions (Liu and Lee, 2022). Then again there are multiple global central banks including the Federal Reverse that have been facing challenges in inflation control by increasing the rate of interest contributing to the rising value of gold (Sui et al.2021). This ends up making the concerns relating to defaults a burning issue these days and hence high-profile traders look to protect their portfolios by investing either in the Bond markets or in gold. Right now, the gold industry seems like it is putting its level best effort into doing everything that it is capable of to rise and reach all-time highs while 2024 probably is going to be another incredibly turbulent year in terms of gold price. Ironically, somewhat, gold market remained attractive because of the printing of money which previously had happened (Esparcia et al.2022). The debasement of dollar attracted the investors to a larger extent, however, presently with the enrichment of the US dollar, gold has been beginning to be utilized for protecting wealth which implies that both gold and the US dollar are on the rise. Inflation is responsible for damaging several currencies which is also applicable for the US dollar. Nevertheless, the goal remains one of the most original currencies and will undoubtedly be increasing in value (Nguyen and Walther, 2020).

The factors that impact the price of gold:

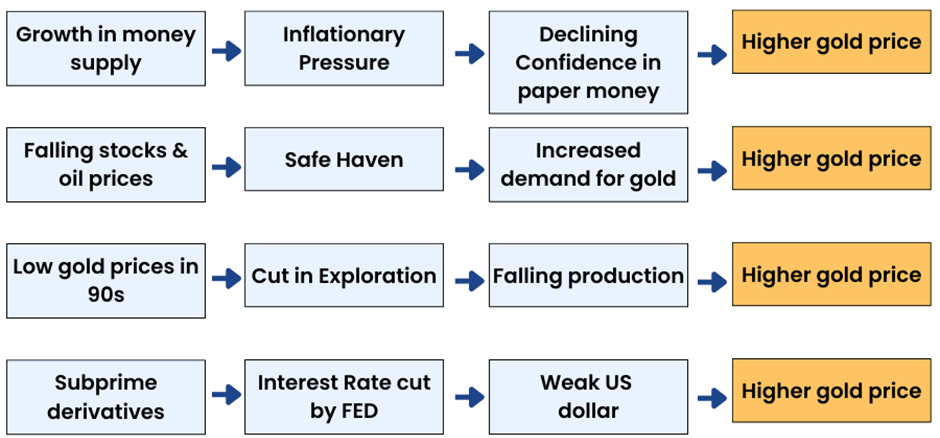

Figure 3. The impact of different factors on gold price

(Source: Trabelsi et al.2021)

Since gold is a highly established and mature asset, there are multiple aspects that come into play during determining the price of gold. Also gold remains one of the unique assets to invest in as compared to bonds and stocks which also impacts its price. Furthermore, the gold industry runs as a hedge which implies that one requires looking for aspects that influence differently the other assets (Liu and Lee, 2022). There are several potential factors taken account into such as demand for consumption, safety against inflation, volatility, the declining value of the dollar, prediction of demand increase for gold, geopolitical aspects, good monsoon, an increasing rate of interest and its impact on other assets. However, consumption demand is all about using gold as an asset kept from its market and the demand for this metal continues fluctuating which currently is bolstered by its application in the electronics manufacturing industry to achieve high conductivity (Fairbairn, 2021). Additionally, gold is worn as jewellery and there exists a potential drive in its demand from international governments that would like to preserve this metal for storing value that they could preserve in their central backs. It is an asset that supports the ones that look to protect themselves from uncertainty and volatility by being a physical resource that is worth preserving (González et al.2021).

The gold market keeps on moving diversely and so is its demand for individuals hedging against volatility. The underlining attraction for gold as an asset for hard days, a majority of investors like to invest in gold regardless of the growth or decline of their domestic economy (Trabelsi et al.2021). Additionally, there is a close connection between inflation and gold since money ends up devaluing quickly due to inflation and under such circumstances, people tend to store their money in the form of something which is going to grow like gold (Le et al.2021). Hence, when inflation sustains, gold turns into an effective inflation hedge asset to combat this financial hardship resulting in pushing the forecast of gold price high during the inflationary timeframes. Similarly, gold and the rate of interest are closely connected in fluctuating gold prices with declining rates of interest which generally take place in the face of financial turbulence and when the government encourages people to invest, implies that saving becomes difficult. However, buying more gold indicates a decreasing rate of interest and the value of saving gets maintained by means of this precious asset (Smith, 2020). As researched by industry experts, in normal situations, there exists a negative relationship between interest rates and gold. Also, there are situations that impact the price of gold from regional locations that are impacted by factors like the climate condition. For instance, in India, the yearly consumption of gold is 800 to 850 tonnes while the rural parts of the country are responsible for the consumption of around 60% of the overall gold of the country (Fairbairn, 2021).

Conclusion:

Since gold is one of the well-established assets across the globe besides being a rather slow-paced and steady market to invest in, there have been a number of predictions that could come into play in the growing price of this precious asset. Undoubtedly, there are certain unpredictable aspects such as the supply of mining and geo-political turbulence that are supposed to be taken under consideration. However, also there have been lots of parameters that accelerated the price of gold, including the growing requirement for safe-haven assets and the increasing inflation of currencies. Furthermore, the narrative of the digital goal has likewise been ranking the market cap of gold. The trend still has been increased given the level of optimism that this asset is associated with. The gold market has started making a comeback with the sluggish pace of the bitcoin industry. On top of the burning factors of the current time such as concerns related to inflations, global turbulence economic volatility etc. all indicate a significant price increment or sustained stability in gold prices in the near future.

assignment help Leeds, essay help Leeds, dissertation writing help Leeds

References:

Blas, J. and Farchy, J., 2021. The world for Sale: money, power, and the traders who barter the Earth’s resources. Oxford University Press.

Esparcia, C., Jareño, F. and Umar, Z., 2022. Revisiting the safe haven role of Gold across time and frequencies during the COVID-19 pandemic. The North American Journal of Economics and Finance, 61, p.101677.

Fairbairn, M., 2021. Fields of gold: Financing the global land rush (p. 234). Cornell University Press.

González, M.D.L.O., Jareño, F. and Skinner, F.S., 2021. Asymmetric interdependencies between large capital cryptocurrency and Gold returns during the COVID-19 pandemic crisis. International Review of Financial Analysis, 76, p.101773.

Le, T.H., Le, A.T. and Le, H.C., 2021. The historic oil price fluctuation during the Covid-19 pandemic: What are the causes?. Research in International Business and Finance, 58, p.101489.

Liu, M. and Lee, C.C., 2022. Is gold a long-run hedge, diversifier, or safe haven for oil? Empirical evidence based on DCC-MIDAS. Resources Policy, 76, p.102703.

Nguyen, D.K. and Walther, T., 2020. Modeling and forecasting commodity market volatility with long‐term economic and financial variables. Journal of Forecasting, 39(2), pp.126-142.

Smith, G., 2020. Data mining fool’s gold. Journal of Information Technology, 35(3), pp.182-194.

Sui, M., Rengifo, E.W. and Court, E., 2021. Gold, inflation and exchange rate in dollarized economies–A comparative study of Turkey, Peru and the United States. International Review of Economics & Finance, 71, pp.82-99. Trabelsi, N., Gozgor, G., Tiwari, A.K. and Hammoudeh, S., 2021. Effects of price of gold on Bombay stock exchange sectoral indices: new evidence for portfolio risk management. Research in International Business and Finance, 55, p.101