Introduction

Investments should be diversified on a global scale, across all regions and countries. In today’s globalised economy, this means diversifying holdings across geographies, sectors, and asset types. Reducing a portfolio’s sensitivity to regional or industry-specific economic changes is the goal of this strategy, along with increased potential returns. Individual investors, not only banks and other huge financial organisations, may benefit by diversifying their holdings throughout the world. By expanding into other markets, businesses may avoid the ups and downs of just one economy and get access to previously unavailable possibilities. This introductory section lays the groundwork for future discussions and AI essay checker for new financial environment and its need for global diversification along with its many advantages.

Discussion

Global Diversification and Its Importance

Allocating a portion of the portfolio to overseas and emerging market companies in along with the U.S. markets is an example of global diversification.

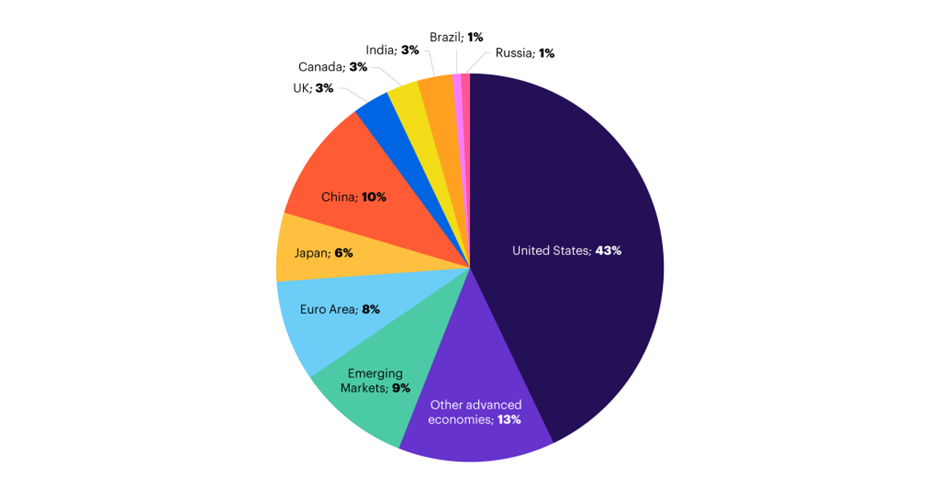

We feel it is critical to have specific allocations to both foreign and emerging market businesses throughout all of the strategy’s portfolios since roughly half of the world’s stock market possibilities are located outside of the United States (Beillouin et al., 2019).

Economies outside the United States, and especially those in developing markets, are forecast to expand at faster rates over the long run. Returns on stock markets in such nations might profit from such astronomical growth rates. Investing specifically in countries with greater growth rates may boost long-term portfolio returns.

Various markets in Global Diversification

Large, advanced economies like those of the United States, Germany, Canada, and Japan are known as “developed markets.” The majority of these nations have advanced economies, stable governments, and excellent living standards. Financial institutions and capital markets in developed nations are usually robust and open to foreign investors (Thomson et al., 2021). Investing in an established market is often safer than investing in an emerging economy.

India, Brazil, and China are examples of nations that are on the cusp of becoming established markets and hence are termed emerging markets. The political or financial structures of these nations are typically less stable than those in industrialized markets, but their middle classes are expanding rapidly. Despite being smaller in size and more unpredictable than established countries, investing in emerging markets may give exposure to new geographic areas and larger potential development prospects.

Figure 1: Global Diversification among countries

Some rising markets are considered to be on the frontier. Countries like Serbia, the nation of Kenya, and Vietnam are good examples of those with economies and governments still in their formative phases, therefore they have low per capita incomes, poor infrastructure, and laxer oversight (Elsayed et al., 2020). Since frontier markets are often linked with smaller firms and marketplaces and are often less liquid, they might be among the most dangerous non-US investments. However, frontier markets have the potential to grow stronger over a number of decades, so investors may seek to them for long-term gains.

Strategies

Horizontal Diversification

In this strategy, people buy or create supplementary goods and services that the existing clientele will find useful. A common example read my essay to me and is the introduction of a new candy flavour by an ice cream shop (Huang et al., 2023). To diversify in this manner, people may need to invest in new tools, acquire new expertise, or try a different advertising strategy.

Concentric Diversification

The key is to expand into untapped markets while maintaining technical and marketing synergy with established sectors. A PC company could decide to expand AI Checker into laptop production, for instance. people might potentially diversify while making use of the technology, tools, and promotion people already have in place.

Diversification of conglomerates

To diversify into a conglomerate, a company must introduce additional lines of activity that are unconnected to the original. A movie company could decide to build an amusement park (Metian et al., 2020). This strategy is fraught with peril since it involves not only breaking into a new market but also selling to a whole new set of consumers.

Vertical Diversification

This refers to growing in either the earlier or later stages of the product’s manufacturing process. With this strategy, people may potentially exert influence over many links in the distribution process. Distributors often create their own films, while tech companies often operate their own retail outlets.

Challenges

- Currency risk is a major obstacle to global diversity. Exchange rate fluctuations might reduce the profitability of overseas investments. Unpredictability in foreign governments and economies additionally represents a threat. Due to these unknowns, investments may be negatively impacted by unexpected policy shifts or crises.

- Investors may need help to traverse international markets due to the fact that regulatory regimes, tax rules, and standards for disclosure may vary from country to country (Beillouin et al., 2021). Management of multinational assets might be further complicated by cultural and language barriers.

- Trading charges, expenses for management, and taxation may all add up to make global diversification more expensive than investing locally. Last but not least, although diversity might lessen losses, it can also dilute prospective gains, reducing total returns. Investors need to do their homework, keep up with world news, and precisely good risk management if they want to weather these storms.

Conclusion

Investments should be spread out geographically around the world. To do so in the current globalized economy requires spreading investments across different regions, industries, and asset classes. Long-term projections indicate stronger growth in economies beyond the United States, particularly those in emerging markets. Such countries’ stock market returns might benefit from such sky-high growth rates. Portfolio returns over the long run may be improved by targeting investments toward nations with stronger economic development. To become a conglomerate, a business must first launch new, unrelated business lines. Investing in developing markets may provide exposure to new geographic regions and bigger prospective growth chances while being lower in size and more uncertain than established nations.