Growth of Derivative Market in the USA

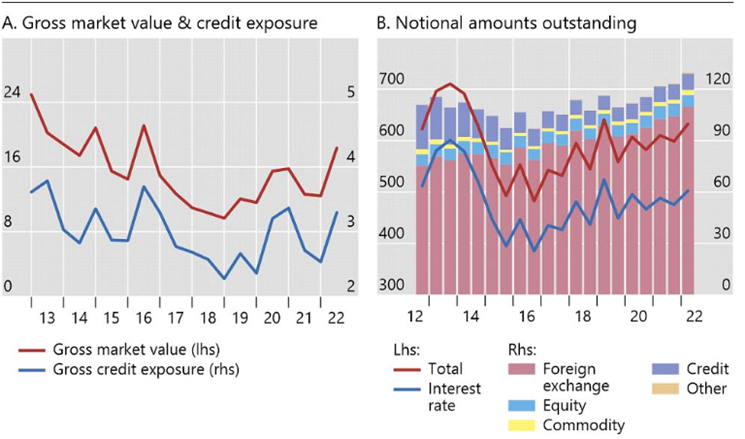

Derivative market defines the financial market for the financial instruments, like future contracts as well as options along with derivatives which can be derived from the other form of assets. In general, it should be noted that, derivative markets can be two types, namely, exchange traded derivatives as well as over the counter derivatives (Zazzara, 2020). Within the derivative market, the legal nature of the products is different than other markets. In accordance with this discussion, it can be stated that, the derivative market and its products are different in terms of their trading procedure, but still there are different participants within the market who are active in both way. However in this regard, in relation to the USA market, it can be stated that the notional value of the outstanding over the counter or OTC derivatives have been increased to the $632 trillion by end of the June 2022 compared to the last year, which was $598 trillion by end of the June 2021 (Chikwira et al. 2021). Thus, from this scenario it can be stated that, the trend of this market within the USA has maintained in a continuous moderate and upward manner from the end of 2016.

Figure 1: Outstanding OTC Derivatives

(Source: bis.org, 2023)

On the other side it can be found out that the gross market value of the outstanding OTC derivatives which further consists of both positive as well as negative values have been increased to $18.3 trillion by the first half of the 2022. This situation therefore has been led by the increase in the interest rate derivatives. Along with this, it can be seen that the value of several commodity derivates have faced the surged against the background of the price rise of energy as well as food in this context (Duran and Griffin, 2021). Thus, in this regard, it can be seen that uncertainty due to high inflation across different economies and outbreak of the Ukraine and Russia war has driven the developments within the derivative markets for the first half of 2022 in this context.

Impact of Derivative Market after Recession

Based on the above discussion it can be seen that derivatives can be the financial instruments which can be build on the above if other financial instruments, like, commodities, securities and more (Henkel, 2019). In accordance with this discussion, it can be seen that as derivatives are essentially traded on the basis of the value of the underlying assets, any kinds of disproportionate situations can fall in the value of the underlying assets can cause the totally crash in the derivatives which has been designated for that purpose in this context. This kind of situation therefore has been aroused during the financial crisis in 2007 as at that time within the USA the housing market has been started to go bust (Spears, 2019). But it can be seen that the bankers were able to manage to keep devised derivatives for this kind of event, for which it was acceptable to hedge the risks for them. Now due to this kind of situation, there has been balance between the hedge funds as well as investment banks in relation to the different hedging instruments which were able to survive this 2008 financial crash. But the banks like Lehmann or similar which were at the high risk due to their exposure to the subprime securities market, have been collapsed in this time. Hence, in this regard it can be stated that the absence of the regulations have been played key role for causing the crisis as the derivatives which were traded in the over the counter segment can define that they are not the subject for the regulation purpose (Paolini, 2020). Hence banks can easily impose their own rules for the derivative which can be traded outside if the regulator’s purview.

Reference list

bis.org, (2023), OTC derivatives statistics at end-June 2022, Available at: https://www.bis.org/publ/otc_hy2211.htm#:~:text=The%20gross%20market%20value%20of%20outstanding%20derivatives%20%E2%80%93%20summing%20positive%20and,A). [Accessed on 31.05.2023]

Chikwira, C., Rawjee, V.P. and Balkaran, R., 2021. Is there a Causality between Economic Growth Variables and Derivatives Usage?. Acta Universitatis Danubius. Œconomica, 17(1).

Duran, R.E. and Griffin, P., 2021. Smart contracts: will Fintech be the catalyst for the next global financial crisis?. Journal of Financial Regulation and Compliance, 29(1), pp.104-122.

Henkel, C., 2019. Using central counterparties to limit global financial crises. U. Cin. L. Rev., 88, p.397.

Paolini, A., 2020. The Disruptive Effect of Distributed Ledger Technology and Blockchain in the over the counter derivatives market. Global Jurist, 20(2).

Spears, T., 2019. Discounting collateral: quants, derivatives and the reconstruction of the ‘risk-free rate’after the financial crisis. Economy and Society, 48(3), pp.342-370.

Zazzara, C., 2020. The new OTC derivatives landscape:(more) transparency, liquidity, and electronic trading. Journal of Banking Regulation, 21, pp.170-187.

SourceEssay is equipped with appropriate resources with the best Online assignment help New York experts to cater marking-related needs. Source Essay sets itself apart through its matchless online assignment help service and cooperation. We have set up quality check parameters and guidelines for all our writers and reviewers to ensure that the work that reaches you is 100 percent original and essay typer with highly qualified essay writers and online essay writing services in USA ho have years of experience and vast expertise in their respective fields, we ensure the best work. for us at Source Essay, customer satisfaction and loyalty is our best validation